The $2B Case for Buying, Not Building: Entrepreneurship Through Acquisition Explained

- elisetanyeeling

- Aug 12, 2025

- 2 min read

Reflecting on our partner Gen Capital Partners' recent LinkedIn post and The Business Times article -Why Entrepreneurship Through Acquisition (ETA) Is a Billion-Dollar Opportunity.

If you’ve ever dreamed of owning a business, you don’t always need to start from scratch. Entrepreneurship Through Acquisition (ETA) is the strategy of buying an existing, profitable business — and it can be a shortcut to wealth creation.

One of the most remarkable ETA success stories is Japan Elevator Service Holdings Co. This little-known Japanese company quietly built an empire by acquiring “heirless” family-run businesses — companies with no successors when the owners retired.

Since its IPO in 2017, Japan Elevator Service Holdings’ share price has surged nearly 6,000%, with a market capitalisation exceeding US$2 billion.

The Japan Elevator Service ETA Playbook

The company’s acquisition strategy focused on:

Targeting profitable, established SMEs with retiring owners

Buying companies with existing customers, cash flow, and proven operations

Specialising in boring but essential services (elevator maintenance)

Consolidating fragmented industries facing succession crises

This approach allowed them to dominate their niche — growing revenue, profit, and market share while competitors struggled.

Why ETA Is a Global Trend — and a Southeast Asian Gold Rush

This isn’t just a Japanese phenomenon. Across Asia, Europe, and North America, baby boomer business owners are retiring in record numbers. Most have no succession plan, creating a once-in-a-generation opportunity for savvy entrepreneurs.

Here in Southeast Asia, thousands of SMEs are profitable, cash-generating, and ready for new leadership. Many are in essential industries like logistics, manufacturing, maintenance, healthcare, and F&B.

We call this the “Silver Gold Rush” — the chance to acquire strong businesses, modernise them, and grow them further.

Why Buy Instead of Build?

Buying an existing SME offers huge advantages over starting a new business:

✅ Immediate revenue and cash flow

✅ Established brand and customer base

✅ Experienced staff and operational systems

✅ Opportunities to scale through digital transformation and expansion

Sometimes the fastest way to create wealth isn’t building a new business — it’s buying one that already works.

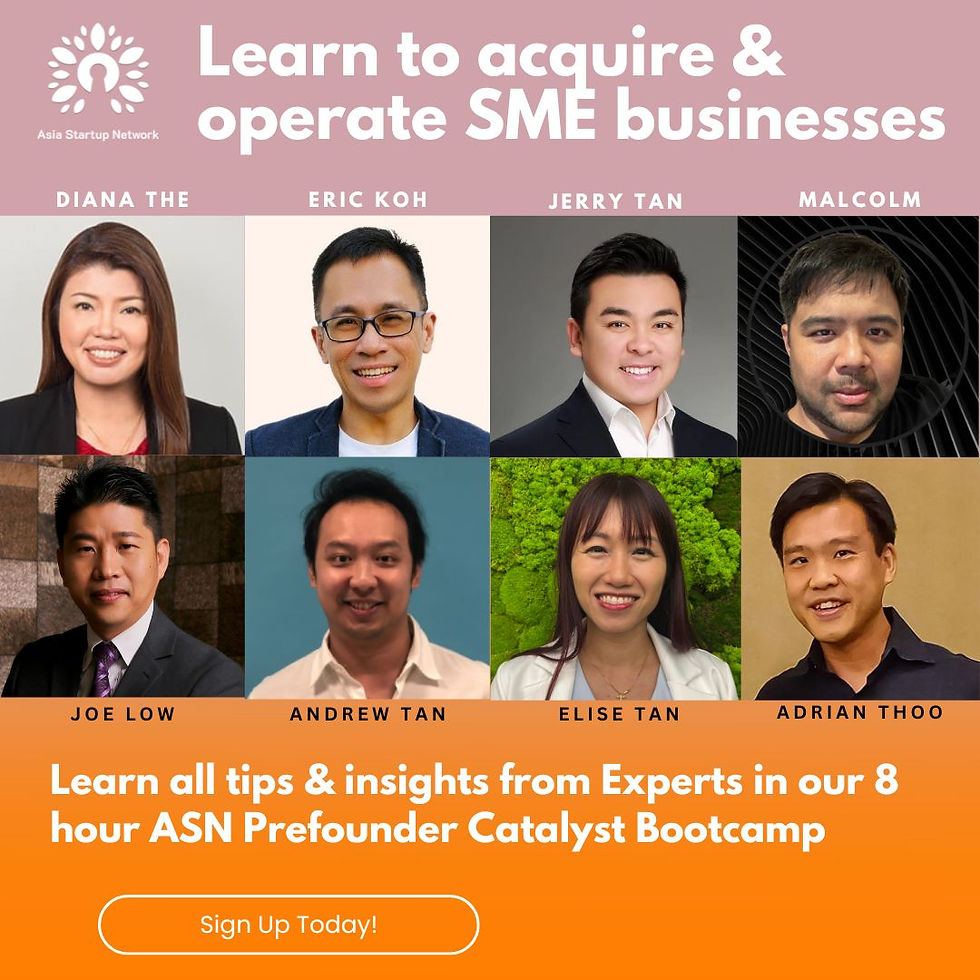

Learn ETA at our upcoming ASN Prefounder Bootcamp taught by Gen Capital Partners' cofounder Eric Koh and other seasoned entrepreneurs

The Prefounder Bootcamp: Entrepreneurship Through Acquisition is your crash course in:

Finding businesses to buy

Evaluating deals and conducting due diligence

Financing your acquisition

Transitioning ownership smoothly

Growing your new business post-acquisition

Hear from experienced business buyers, investors, and SME operators who have successfully taken over and scaled existing companies.

VIEW the speakers profiles here:lu.ma/asn-eta3

📅 Date: 23 and 30 August 2025

📍 Location: N9 offices, Chinatown point

🔗 Register Now: lu.ma/asn-eta3

For any questions, please email marketing@asiastartupnetwork.com.

Comments